Delving into the realm of Automotive Insurance Quote Optimization: What Netherlands Drivers Should Know, we uncover a wealth of information that sheds light on the intricacies of insurance quotes. This journey promises to be both enlightening and informative, offering valuable insights for drivers navigating the insurance landscape in the Netherlands.

As we delve deeper into the topic, we will explore various facets of automotive insurance, from understanding the legal requirements to optimizing insurance quotes for cost savings.

Overview of Automotive Insurance in the Netherlands

Automotive insurance is a crucial aspect of driving in the Netherlands, providing financial protection in case of accidents, theft, or damage to your vehicle. It is mandatory for all drivers to have at least basic third-party liability insurance to cover damages caused to others.

Types of Automotive Insurance

- Third-Party Liability Insurance: Covers damage to others’ property or injuries in an accident where you are at fault.

- Third-Party, Fire, and Theft Insurance: Includes coverage for theft and fire damage to your vehicle in addition to third-party liability.

- Comprehensive Insurance: Offers the most extensive coverage, including damage to your own vehicle in accidents, theft, fire, and more.

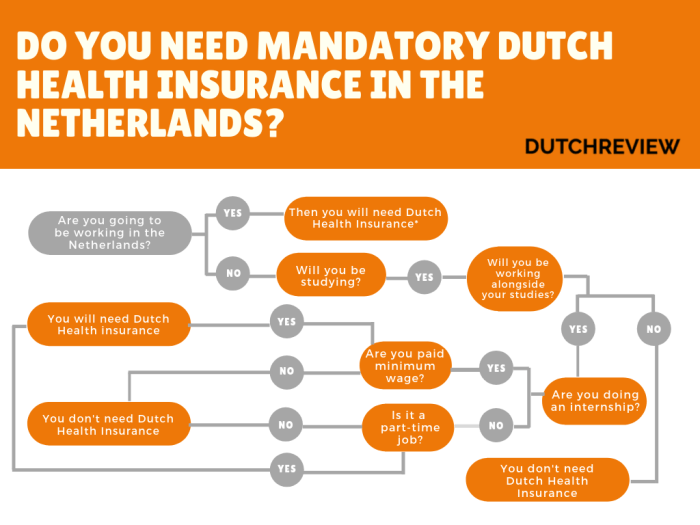

Legal Requirements

All drivers in the Netherlands are required by law to have at least third-party liability insurance. This insurance must meet the minimum coverage amounts set by the government to ensure adequate protection for all parties involved in an accident.

Factors Influencing Insurance Quotes

When it comes to determining automotive insurance quotes in the Netherlands, several key factors play a significant role in influencing the cost. Understanding these factors is essential for drivers looking to optimize their insurance premiums.

Driver’s Age and Driving Experience

- The age of the driver is a crucial factor in determining insurance quotes. Younger drivers, especially those under 25, are often considered high-risk due to their lack of experience on the road. As a result, they may face higher insurance premiums compared to older, more experienced drivers.

- Driving experience also plays a role in insurance quotes. Drivers with a long history of safe driving and no claims are likely to receive lower premiums, as they are perceived as lower risk by insurance companies.

Type of Vehicle and its Age

- The type of vehicle you drive can significantly impact your insurance premium. High-performance cars, luxury vehicles, and sports cars are typically more expensive to insure due to their higher repair costs and increased likelihood of theft.

- The age of the vehicle is another important factor. Newer cars may be more expensive to insure due to their higher value, while older vehicles may have lower premiums but could be more costly to repair in case of an accident.

Understanding Quote Optimization

When it comes to automotive insurance, quote optimization refers to the process of maximizing the coverage you need while minimizing the cost of your insurance premiums. By strategically adjusting various factors, drivers in the Netherlands can tailor their insurance quotes to suit their specific needs and budget.

Strategies for Optimizing Insurance Quotes

- Compare Multiple Quotes: Obtain quotes from different insurance providers to compare coverage options and prices.

- Adjust Coverage Levels: Evaluate your coverage needs and adjust deductibles and limits to find a balance between protection and cost.

- Bundle Policies: Consider bundling your automotive insurance with other types of insurance, such as home or life insurance, to potentially receive discounts.

- Improve Driving Record: Maintaining a clean driving record can lead to lower insurance premiums over time.

- Utilize Discounts: Take advantage of any discounts available, such as for safe driving habits, anti-theft devices, or low mileage.

Benefits of Quote Optimization

- Cost Savings: By optimizing your insurance quote, you can potentially save money on your premiums without sacrificing necessary coverage.

- Customized Coverage: Tailoring your insurance quote allows you to select the specific coverage options that best suit your individual needs and circumstances.

- Peace of Mind: Knowing that you have optimized your insurance quote gives you confidence that you are adequately protected while staying within your budget.

Comparison of Insurance Providers

When it comes to automotive insurance in the Netherlands, drivers have a variety of options to choose from. It’s essential to compare different insurance providers to find the best coverage that suits your needs and budget.

Key Features and Benefits of Insurance Providers

- Provider A:Offers comprehensive coverage with roadside assistance included.

- Provider B:Specializes in discounts for safe drivers and offers a user-friendly mobile app for claims.

- Provider C:Known for excellent customer service and quick claims processing.

- Provider D:Provides flexible payment options and customizable coverage plans.

Customer Reviews and Satisfaction Ratings

- According to customer reviews, Provider A has received high ratings for their affordability and ease of claims process.

- Provider B has been praised for their innovative approach to insurance and personalized discounts.

- Customers of Provider C have highlighted their efficient customer service and prompt resolution of issues.

- Provider D has been commended for their transparency in pricing and flexibility in coverage options.

Tips for Getting the Best Quotes

When it comes to getting the best automotive insurance quotes in the Netherlands, there are several key tips that drivers should keep in mind. By following these tips, drivers can ensure that they are getting the most competitive rates and coverage options available to them.

Compare Quotes from Multiple Insurance Providers

One of the most important tips for getting the best automotive insurance quotes is to compare quotes from multiple insurance providers. By obtaining quotes from several different companies, drivers can ensure that they are getting a comprehensive view of the available options and pricing.

This can help them identify the best value for their specific needs and budget.

Consider the Role of Deductibles and Coverage Limits

Another important factor to consider when seeking the best insurance quotes is the role of deductibles and coverage limits. Deductibles are the amount of money that drivers must pay out of pocket before their insurance coverage kicks in, while coverage limits determine the maximum amount that an insurance provider will pay out for a claim.

By adjusting these factors, drivers can often lower their insurance premiums, but it’s important to strike the right balance to ensure adequate coverage in the event of an accident.

Final Conclusion

In conclusion, Automotive Insurance Quote Optimization: What Netherlands Drivers Should Know encapsulates essential knowledge for drivers seeking to make informed decisions about their insurance coverage. By leveraging the insights shared in this discussion, drivers can navigate the insurance market with confidence and secure the best possible quotes tailored to their needs.

Helpful Answers

What are the legal requirements for automotive insurance in the Netherlands?

Drivers in the Netherlands are required to have at least third-party liability insurance to cover damages to others in case of an accident.

How can drivers optimize their insurance quotes in the Netherlands?

Drivers can optimize their quotes by comparing offers from multiple providers, adjusting deductibles, and exploring discounts based on their driving history.

What factors besides the type of vehicle influence insurance quotes in the Netherlands?

Apart from the vehicle type, factors like the driver’s age, driving experience, and claims history play a significant role in determining insurance quotes.