Delving into Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing?, this introduction immerses readers in a unique and compelling narrative. The current landscape of automotive insurance in Saudi Arabia is undergoing significant shifts, with emerging trends reshaping the market dynamics and consumer behavior.

From technological advancements to evolving pricing strategies, the industry is experiencing a wave of transformation. Let’s explore what’s changing in the realm of automotive insurance quotes in Saudi Arabia.

Automotive Insurance Market Overview in Saudi Arabia

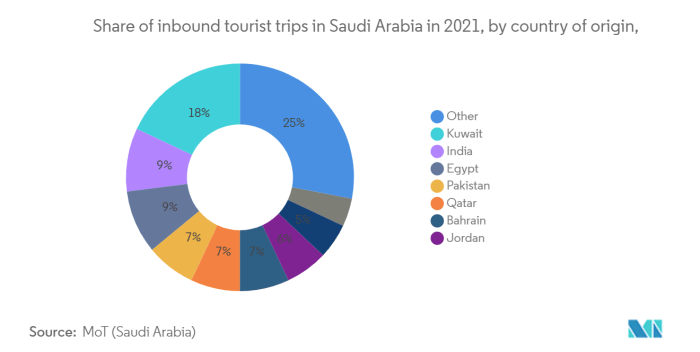

In Saudi Arabia, the automotive insurance market is a crucial sector that provides coverage for vehicles against potential risks and accidents. With the increasing number of vehicles on the roads, the demand for automotive insurance has been on the rise.

Key Players in the Automotive Insurance Industry

- Saudi Arabian Cooperative Insurance Company

- Tawuniya

- AXA Cooperative Insurance

- Metlife AIG ANB Cooperative Insurance

Regulatory Environment for Automotive Insurance

Saudi Arabia has a well-defined regulatory framework for automotive insurance to ensure fair practices and protection for policyholders. The Saudi Arabian Monetary Authority (SAMA) plays a key role in regulating the insurance industry in the country.

It is mandatory for all vehicle owners in Saudi Arabia to have valid automotive insurance coverage to legally operate their vehicles on the roads.

Emerging Trends in Automotive Insurance Quotes

In recent years, the automotive insurance landscape in Saudi Arabia has been evolving rapidly, with various trends shaping the way insurance quotes are calculated and provided to customers. Factors such as technological advancements, changing consumer behavior, and regulatory developments are influencing the changes in automotive insurance premiums.

Impact of Technology on Obtaining Insurance Quotes

Technology has revolutionized the process of obtaining insurance quotes in Saudi Arabia. Insurers are now utilizing advanced data analytics and artificial intelligence to assess risk factors more accurately. This allows them to tailor insurance quotes based on individual driving habits, vehicle specifications, and other relevant data points.

As a result, customers can now receive more personalized and competitive insurance quotes that better align with their unique needs and preferences.

Consumer Behavior and Preferences

Consumer behavior plays a significant role in shaping the automotive insurance market in Saudi Arabia. Let’s delve into how consumer preferences are evolving and impacting the selection of insurance coverage options.

Changing Approach to Seeking Quotes

Consumer behavior towards seeking automotive insurance quotes is shifting towards online platforms. With the convenience of comparing multiple quotes at once, more consumers are opting for digital channels to explore their options. This trend is driven by the desire for transparency and ease of access to information.

- Online comparison tools have become increasingly popular among consumers, allowing them to easily compare different coverage options and prices.

- Mobile apps and websites offered by insurance providers have made it more convenient for consumers to obtain quotes and purchase policies on-the-go.

- The shift towards digital platforms has also been accelerated by the COVID-19 pandemic, as more consumers prefer contactless transactions and interactions.

Preferences in Selecting Insurance Coverage

When it comes to selecting insurance coverage, consumers in Saudi Arabia prioritize factors such as price, coverage options, and customer service. Understanding consumer preferences can help insurance providers tailor their offerings to better meet the needs of their target market.

- Price remains a key factor for consumers when choosing automotive insurance, with many seeking the best value for their money.

- Comprehensive coverage options that provide protection against a wide range of risks are preferred by consumers looking for comprehensive financial security.

- Customer service quality, including responsiveness, claims processing efficiency, and overall satisfaction, plays a crucial role in consumer decision-making.

Role of Customer Reviews and Feedback

Customer reviews and feedback have become increasingly influential in shaping consumer decisions when it comes to selecting automotive insurance. Positive reviews can build trust and credibility for insurance providers, while negative feedback can deter potential customers from choosing a particular company.

- Consumers often rely on online reviews and testimonials to gauge the reputation and reliability of insurance providers before making a decision.

- Word-of-mouth recommendations from friends and family members also hold significant weight in influencing consumer choices.

- Insurance companies that actively engage with customer feedback and address concerns promptly are more likely to attract and retain loyal customers.

Technological Advancements in Insurance Quoting

In today’s digital age, technological advancements have significantly transformed the process of obtaining insurance quotes, making it more efficient and convenient for consumers.

Impact of AI and Machine Learning on Insurance Quotes

AI and machine learning algorithms have revolutionized the accuracy of insurance quotes by analyzing vast amounts of data to predict risk factors more effectively. These technologies help insurance companies tailor quotes to individual customers based on their specific needs and behaviors.

- AI algorithms can assess a customer’s driving habits, previous claims history, and other relevant factors to provide a personalized insurance quote.

- Machine learning can continuously improve the accuracy of insurance quotes by analyzing real-time data and trends in the market.

- By leveraging AI and machine learning, insurance companies can offer more competitive rates and better coverage options to consumers.

Role of Online Platforms in Providing Instant Quotes

Online platforms have become instrumental in providing instant insurance quotes to consumers, offering a seamless and user-friendly experience for obtaining quotes anytime, anywhere.

With just a few clicks, consumers can compare multiple insurance quotes from different providers, making it easier to find the best coverage at the most competitive price.

- Online platforms use advanced algorithms to generate accurate insurance quotes quickly, saving consumers time and effort.

- Consumers can easily input their information and preferences online, allowing insurance companies to tailor quotes to their specific needs in real-time.

- The convenience of online platforms has led to a rise in digital insurance transactions, making it easier for consumers to purchase and manage their policies online.

Pricing Strategies and Competition

In the automotive insurance market of Saudi Arabia, pricing strategies play a crucial role in attracting customers and gaining a competitive edge. Let’s delve into the various pricing strategies employed by insurance companies in the region and how they are evolving to meet the changing consumer demands.

Pricing Strategies Employed

- Insurance companies in Saudi Arabia often use competitive pricing strategies to attract customers. This involves offering lower premiums or discounts compared to their competitors to entice new policyholders.

- Some insurers focus on value-based pricing, where they highlight the unique benefits and coverage options of their policies to justify slightly higher premiums.

- Dynamic pricing is also gaining popularity, where insurance companies adjust their rates based on the individual risk profile of the customer, using data analytics and telematics to determine personalized premiums.

Competitive Landscape

- The automotive insurance market in Saudi Arabia is highly competitive, with both local and international insurance providers vying for market share.

- Key players in the market include Tawuniya, MedGulf, and AXA, among others, each offering a range of policies and services to attract customers.

- Competition is intense, leading to innovative pricing strategies and promotional offers to differentiate themselves and capture a larger customer base.

Evolving Pricing Strategies

- With the rise of digitalization, insurance companies are increasingly focusing on online platforms and mobile apps to streamline the quoting process and offer instant quotes to customers.

- Personalization is becoming a key factor in pricing strategies, with insurers leveraging data analytics to tailor premiums based on individual customer behaviors and risk factors.

- Customer retention is also a priority, with loyalty programs and bundled services being used as incentives to keep existing policyholders and attract new ones.

Future Outlook and Predictions

The future of automotive insurance quotes in Saudi Arabia is poised for significant changes and developments. As technology continues to advance and consumer preferences evolve, the insurance industry is expected to undergo transformation.

Increased Personalization and Customization

In the future, automotive insurance quotes in Saudi Arabia are likely to become more personalized and tailored to individual drivers. With the use of telematics and data analytics, insurance companies can gather real-time information about a driver’s behavior and driving habits.

This data can then be used to offer customized quotes based on actual risk factors, ultimately leading to fairer pricing and improved accuracy in assessing premiums.

Rise of Insurtech Companies

As technology plays a more prominent role in the insurance industry, we can expect to see a rise in the number of Insurtech companies in Saudi Arabia. These companies leverage technology to streamline processes, offer innovative products, and provide a more seamless customer experience.

Insurtech companies are likely to disrupt traditional insurance models and drive competition within the market, ultimately benefiting consumers with more choices and better services.

Shift towards Usage-based Insurance

Usage-based insurance, which determines premiums based on actual vehicle usage rather than traditional risk factors, is expected to gain traction in Saudi Arabia. With the advent of connected cars and IoT devices, insurance companies can track driving patterns, mileage, and behavior in real-time.

This shift towards usage-based insurance could lead to more affordable premiums for low-risk drivers and incentivize safer driving practices among policyholders.

Impact of Regulatory Changes

Anticipated regulatory changes in the insurance sector, aimed at enhancing consumer protection and promoting transparency, could significantly impact the future of automotive insurance quotes in Saudi Arabia. Stricter regulations regarding pricing practices, claims processing, and data privacy may shape how insurance companies operate and interact with customers.

Adapting to these regulatory changes will be crucial for insurers to stay competitive and maintain consumer trust.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning algorithms in insurance processes is expected to revolutionize the way quotes are generated and premiums are calculated. By leveraging AI-powered systems, insurers can automate underwriting processes, detect fraud more effectively, and enhance customer service through chatbots and virtual assistants.

This technological advancement is likely to streamline operations, reduce costs, and improve overall efficiency in the insurance industry.

Conclusive Thoughts

In conclusion, the automotive insurance sector in Saudi Arabia is witnessing a period of rapid evolution. As trends continue to emerge and consumer preferences shift, the future of insurance quotes in the region remains dynamic and full of potential. Stay informed and prepared for the changing landscape of automotive insurance in Saudi Arabia.

Answers to Common Questions

What factors are influencing changes in automotive insurance premiums?

Changes in automotive insurance premiums are influenced by factors such as the regulatory environment, emerging technologies, and consumer behavior trends. Insurers adjust premiums based on these factors to stay competitive and reflective of the market dynamics.

How is technology impacting the process of obtaining insurance quotes in Saudi Arabia?

Technology is streamlining the process of obtaining insurance quotes in Saudi Arabia by providing online platforms that offer instant quotes. Advancements like AI and machine learning are enhancing the accuracy of quotes, making it more efficient for consumers to compare and select insurance coverage.

What are the key players in the automotive insurance industry in Saudi Arabia?

Some of the key players in the automotive insurance industry in Saudi Arabia include major insurance companies like Tawuniya, MedGulf, and Bupa Arabia. These companies play a significant role in shaping the market dynamics and pricing strategies within the industry.