Discount Car Insurance Quotes: How to Use Date of Birth & Driving History to Your Advantage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Explore the impact of age and driving history on car insurance rates in a way that will leave you informed and empowered.

Importance of Date of Birth in Car Insurance Quotes

When it comes to determining car insurance quotes, the date of birth plays a crucial role in assessing risk and setting premiums. Insurance companies use this information as a key factor in evaluating an individual’s likelihood of being involved in accidents and making claims.

How Age Influences Car Insurance Premiums

Age is a significant determinant in calculating car insurance rates. Younger drivers are typically considered higher risk due to their lack of experience and tendency for riskier behavior, such as speeding. On the other hand, older drivers may face higher premiums due to factors like declining vision and slower reaction times.

- For example, a 20-year-old driver may pay significantly more for insurance compared to a 40-year-old with a similar driving record.

- Insurance companies often offer discounts to drivers over a certain age, such as 55 or 60, as they are deemed more mature and experienced behind the wheel.

Comparing Date of Birth with Other Factors in Determining Insurance Costs

While date of birth is a crucial factor in car insurance pricing, it is not the only consideration. Factors like driving history, vehicle type, location, and annual mileage also play a significant role in determining insurance costs. However, age remains a key component due to its correlation with driving habits and risk levels.

Utilizing Driving History for Lower Insurance Quotes

Maintaining a clean driving record is essential when it comes to securing lower insurance quotes. Insurance companies consider your driving history as a key factor in determining the risk you pose as a driver, which directly impacts the premiums you pay.

Let’s delve into how your driving history affects your insurance rates and what you can do to improve them.

Impact of Driving History on Insurance Rates

- Accidents: Being involved in accidents can significantly increase your insurance premiums. Insurance companies view drivers who have been in accidents as higher risks, as they are more likely to file future claims.

- Tickets: Traffic violations like speeding tickets or running red lights can also lead to higher insurance rates. These violations signal to insurers that you may not always follow traffic laws, increasing the likelihood of future incidents.

- Claims: Making frequent insurance claims, whether for accidents or other incidents, can raise red flags for insurance companies. They may see you as a more costly policyholder and adjust your rates accordingly.

Maintaining a Clean Driving Record for Better Rates

- Drive defensively: Obey traffic laws, follow speed limits, and practice safe driving habits to reduce the risk of accidents and violations.

- Avoid distractions: Stay focused on the road and avoid distractions like texting or using your phone while driving to prevent accidents.

- Attend defensive driving courses: Some insurance companies offer discounts for completing defensive driving courses, which can help offset the impact of past violations.

Different Violations and Their Effects on Insurance Quotes

- Minor violations: Minor infractions like a single speeding ticket may lead to a slight increase in premiums, but they are less severe than major violations.

- Major violations: Serious violations like DUIs or reckless driving can have a significant impact on insurance rates, potentially doubling or tripling your premiums.

- At-fault accidents: Being found at fault in an accident can result in higher premiums, especially if there is significant damage or injuries involved.

Strategies to Leverage Date of Birth and Driving History

When it comes to securing the best car insurance rates, leveraging your date of birth and driving history can make a significant impact. By understanding how age and driving record influence insurance premiums, you can strategically negotiate lower rates and save money on your coverage.

Impact of Age and Driving History on Insurance Premiums

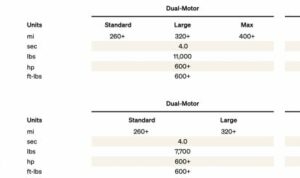

| Age Group | Driving History | Insurance Premiums |

|---|---|---|

| Young Drivers (16-25) | Multiple accidents and traffic violations | High premiums due to high-risk behavior |

| Middle-Aged Drivers (26-50) | Clean driving record | Lower premiums due to lower risk |

| Senior Drivers (51 and above) | Minimal accidents and violations | Stable premiums with safe driving history |

Using Date of Birth and Driving Record to Negotiate Lower Rates

- Obtain a copy of your driving record from the DMV to ensure accuracy.

- Highlight any defensive driving courses or certifications that showcase your commitment to safe driving.

- Emphasize any improvements in your driving behavior, such as a reduction in speeding tickets or accidents.

- Provide your accurate date of birth to showcase your maturity and responsibility as a driver.

Requesting Quotes Based on Optimized Age and Driving History Data

- When requesting insurance quotes, provide your correct date of birth without any discrepancies.

- Share your driving history details accurately to receive personalized quotes based on your risk profile.

- Ask for discounts or special rates based on your age group and safe driving record.

Closing Summary

In conclusion, mastering the art of leveraging your date of birth and driving history can lead to significant savings on your car insurance. By understanding how these factors influence your premiums, you can make informed decisions and secure the best possible rates.

Expert Answers

How does age impact car insurance rates?

Age plays a significant role in determining car insurance premiums. Younger drivers typically face higher rates due to perceived higher risk, while older drivers may enjoy lower premiums.

What violations can affect insurance quotes?

Accidents, tickets, and claims on your driving record can all lead to increased insurance rates. Maintaining a clean driving history is crucial for securing lower premiums.