Navigating the realm of Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada opens up a world of possibilities and challenges. As high-risk drivers face unique hurdles in securing affordable coverage, this guide aims to shed light on the intricacies of finding the right insurance solutions.

Understanding High-Risk Drivers in Canada

High-risk drivers in Canada are individuals who are deemed more likely to be involved in accidents or file insurance claims compared to the average driver. This classification is based on various factors that insurance companies use to assess risk.

Factors that Categorize Drivers as High-Risk in Canada

Several factors contribute to labeling drivers as high-risk in Canada:

- Driving Record: History of accidents, traffic violations, or license suspensions can indicate a higher risk of future incidents.

- Age and Experience: Young drivers or those with limited driving experience are often considered high-risk due to a lack of seasoned skills.

- Vehicle Type: Sports cars, luxury vehicles, or models with high theft rates can increase the risk profile of a driver.

- Location: Residing in areas with high crime rates or high traffic congestion can impact the risk assessment.

Implications of Being Labeled a High-Risk Driver on Insurance Premiums

Being classified as a high-risk driver can lead to several consequences:

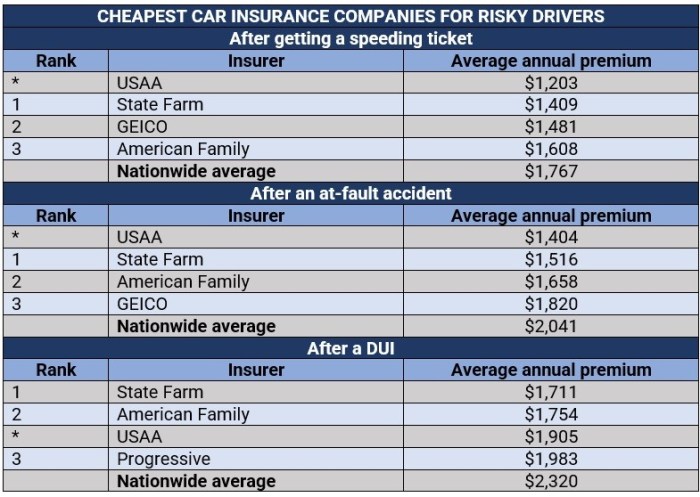

- Higher Premiums: Insurance companies charge higher rates to cover the increased likelihood of claims from high-risk drivers.

- Limited Coverage Options: Some insurers may restrict the coverage options available to high-risk drivers or offer policies with more limited benefits.

- Required SR-22: In certain cases, high-risk drivers may need to file an SR-22 form with their state to prove financial responsibility.

Shopping for Car Insurance as a High-Risk Driver

When you’re classified as a high-risk driver in Canada, shopping for car insurance can be a bit challenging. However, with the right approach, you can find suitable coverage at competitive rates. Here are some tips to help you navigate the process effectively.

Researching Insurance Providers Specializing in High-Risk Driver Coverage

When looking for car insurance as a high-risk driver, it’s crucial to focus on insurance providers that specialize in catering to individuals with your risk profile. These specialized insurers have a better understanding of the unique needs of high-risk drivers and can offer more tailored coverage options.

- Look for insurance companies that have experience dealing with high-risk drivers.

- Read reviews and testimonials from other high-risk drivers to gauge the quality of service and coverage offered.

- Consider reaching out to insurance brokers who can help you navigate the market and find the best options for your specific situation.

Comparing Quotes from Different Insurers

Obtaining quotes from multiple insurance providers is essential when shopping for car insurance as a high-risk driver. By comparing rates and coverage options, you can ensure that you’re getting the best value for your money.

- Request quotes from at least three different insurers to compare rates and coverage terms.

- Pay attention to any discounts or incentives offered by each insurer that could help lower your premiums.

- Consider factors such as deductibles, coverage limits, and additional benefits when evaluating the quotes.

Identifying Key Features in a Policy Tailored for High-Risk Drivers

When reviewing insurance policies for high-risk drivers, it’s important to look for specific features that cater to your needs and provide adequate protection despite your risk profile.

- Look for accident forgiveness programs that can prevent your rates from skyrocketing after a single incident.

- Consider policies that offer flexible payment options to make it easier to manage your premiums.

- Check if the insurer provides options for improving your driving record over time to potentially lower your rates in the future.

Tips for Lowering Insurance Premiums

Maintaining affordable car insurance as a high-risk driver can be challenging, but there are strategies you can implement to lower your insurance premiums and save money in the long run.

Importance of Maintaining a Clean Driving Record

One of the most effective ways to reduce your insurance premiums as a high-risk driver is to maintain a clean driving record. Avoiding traffic violations, accidents, and other infractions can demonstrate to insurance providers that you are a responsible driver, which may lead to lower rates.

Discounts or Programs Available for High-Risk Drivers

Many insurance companies offer discounts or special programs specifically designed for high-risk drivers. These discounts may include safe driving programs, bundling policies, or loyalty rewards. By taking advantage of these offerings, you can potentially save on your insurance premiums while still receiving adequate coverage.

Understanding Insurance Coverage Options

When it comes to car insurance coverage options for high-risk drivers in Canada, it’s important to understand the different types of coverage available to ensure you have the protection you need.

Minimum Insurance Requirements in Canada

In Canada, all drivers are required to have a minimum amount of auto insurance coverage. The mandatory coverage includes:

- Third-Party Liability Coverage: This coverage protects you if you are at fault in an accident that causes injury or damage to another person or their property.

- Accident Benefits Coverage: This coverage provides compensation for medical expenses, lost income, and other benefits if you are injured in a car accident.

- Uninsured Automobile Coverage: This coverage protects you if you are involved in an accident with an uninsured or unidentified driver.

Additional Coverage Options for High-Risk Drivers

High-risk drivers may want to consider additional coverage options to enhance their protection on the road. Some of these options include:

- Collision Coverage: This coverage helps pay for repairs to your vehicle if you are involved in a collision with another vehicle or object.

- Comprehensive Coverage: This coverage protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters.

- Increased Liability Limits: High-risk drivers may benefit from higher liability limits to ensure they are adequately covered in the event of a serious accident.

Closing Summary

In conclusion, Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada serves as a beacon of knowledge for those seeking to navigate the complex landscape of insurance. By implementing the tips and strategies Artikeld here, high-risk drivers can find the coverage they need at prices that won’t break the bank.

Key Questions Answered

What factors classify drivers as high-risk in Canada?

Drivers with a history of accidents, traffic violations, or DUI convictions are often considered high-risk in Canada.

Are there specific discounts available for high-risk drivers in Canada?

Some insurance providers offer discounts for high-risk drivers who complete defensive driving courses or install safety devices in their vehicles.

What are the minimum insurance requirements for high-risk drivers in Canada?

High-risk drivers in Canada are usually required to have at least third-party liability coverage, which covers damages to others’ property or injuries.