Delving into Shop Car Insurance Quotes on a Budget: Australia Edition, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

As we explore the realm of car insurance quotes in Australia on a budget, we uncover essential factors to consider, tips for effective comparison, and the significance of policy coverage limits and exclusions.

Researching Car Insurance Options

When looking for car insurance quotes on a budget, it’s important to research your options thoroughly to find the best coverage at an affordable price. Here are some key factors to consider when shopping for car insurance:

Comparing Different Insurance Plans

- Check the coverage: Make sure to compare the coverage offered by different insurance plans. Look at what is included in the policy and what is excluded.

- Consider the cost: While budget-friendly options are essential, don’t compromise on coverage. Compare prices to find the best value for your money.

- Look at the deductible: A higher deductible usually means lower premiums, but make sure you can afford the out-of-pocket cost if you need to make a claim.

- Research the company: Check the reputation and financial stability of the insurance company before making a decision.

Understanding Policy Coverage Limits and Exclusions

- Policy coverage limits: It’s crucial to understand the maximum amount your insurance will pay out for a claim. Make sure the limits align with your needs and the value of your car.

- Exclusions: Pay attention to what is not covered by your policy. This could include specific situations, types of damage, or certain drivers. Be aware of any exclusions that may affect your coverage.

- Review the fine print: Read through the policy details carefully to ensure you understand all terms, conditions, and limitations.

- Ask questions: If there are any uncertainties about your policy, don’t hesitate to contact the insurance provider for clarification.

Budget-Friendly Insurance Companies in Australia

When looking for budget-friendly car insurance in Australia, it is essential to consider reputable insurance companies that offer competitive prices without compromising on coverage. Here are some top insurance providers known for their affordability and value.

Budget-Friendly Insurance Companies in Australia

- Allianz Australia: Allianz is a well-known insurance company that offers a range of car insurance options at competitive prices. They provide flexible coverage options to suit different budgets and needs.

- Budget Direct: Budget Direct is another popular choice for budget-conscious customers. They offer affordable car insurance plans with various discounts and benefits, such as no-claim bonuses and online discounts.

- Youi: Youi is known for its personalized approach to car insurance, allowing customers to tailor their coverage to fit their budget. They offer competitive rates and discounts for safe drivers.

- Virgin Money: Virgin Money provides comprehensive car insurance policies at competitive prices. They offer various discounts for new customers and loyalty rewards for existing policyholders.

Utilizing Online Comparison Tools

Online comparison tools can be incredibly helpful in finding affordable car insurance quotes in Australia. These tools allow you to easily compare different policies from various insurance companies, helping you choose the best option that fits your budget and coverage needs.

Here is a step-by-step guide on how to use these tools effectively:

Step-by-Step Guide on Using Online Comparison Tools

- Start by visiting a reputable online comparison website that specializes in car insurance.

- Enter your personal details, including information about your car and driving history, to get accurate quotes.

- Specify the level of coverage you require, such as comprehensive, third party, or third party fire and theft.

- Compare quotes from different insurance companies based on price, coverage options, and customer reviews.

- Review the policy details carefully to ensure you understand what is covered and any exclusions or limitations.

- Select the insurance policy that offers the best value for your budget and coverage needs.

Advantages of Using Online Platforms for Insurance Shopping

- Convenience: Online comparison tools allow you to compare multiple quotes from the comfort of your own home, saving you time and effort.

- Cost-effective: By comparing quotes online, you can find the most affordable option that fits within your budget without the need to contact each insurer individually.

- Transparency: Online platforms provide detailed information about each policy, making it easier to understand the coverage options and make an informed decision.

- Instant results: With online comparison tools, you can receive quotes instantly, making the shopping process quick and efficient.

Understanding Policy Inclusions and Exclusions

When it comes to car insurance, understanding the inclusions and exclusions of your policy is crucial for making informed decisions and managing your budget effectively.

Common Inclusions in Car Insurance Policies

- Third-party liability coverage: This covers damages to other vehicles or property in an accident where you are at fault.

- Collision coverage: This helps pay for repairs to your car in case of an accident.

- Comprehensive coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

- Personal injury protection: Covers medical expenses for you and your passengers in case of an accident.

Typical Exclusions in Car Insurance Policies

- Regular wear and tear: Insurance does not cover maintenance costs for your vehicle.

- Driving under the influence: Accidents caused while driving under the influence of alcohol or drugs may not be covered.

- Racing or reckless driving: Any incidents related to illegal activities or reckless driving may be excluded from coverage.

- Unapproved drivers: If an unauthorized person is driving your car and gets into an accident, it may not be covered.

Understanding inclusions and exclusions can impact budgeting for insurance by helping policyholders choose the right level of coverage for their needs and avoid unnecessary expenses.

Maximizing Discounts and Savings

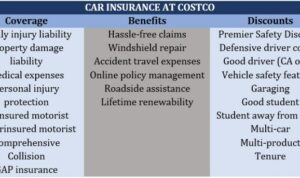

When it comes to car insurance, finding ways to maximize discounts and savings can help you lower your overall costs. Insurance providers often offer various discounts that policyholders can take advantage of to reduce their premiums. By understanding these discounts and knowing how to qualify for them, you can potentially save a significant amount on your car insurance.

Identifying Potential Discounts

- One common discount is the multi-policy discount, where you can save money by bundling your car insurance with other types of insurance, such as home or life insurance.

- Good driver discounts are often available for those who have a clean driving record and have not been involved in any accidents or received traffic violations.

- Some insurance companies offer discounts for safety features in your vehicle, such as anti-lock brakes, airbags, and anti-theft devices.

Tips for Qualifying and Maximizing Savings

- Regularly review your policy and coverage to ensure you are not paying for unnecessary options or coverage that you do not need.

- Consider increasing your deductible, which can lower your premiums but make sure you can afford the out-of-pocket costs if you need to make a claim.

- Ask your insurance provider about available discounts and see if you qualify for any that could help reduce your premium.

Negotiating with Insurance Companies

- Shop around and compare quotes from different insurance companies to leverage competition and potentially negotiate better rates.

- Be prepared to discuss your driving history, any safety features in your vehicle, and other factors that could make you eligible for discounts.

- Consider speaking with a representative from the insurance company directly to see if there are any promotions or discounts available that are not advertised.

Last Recap

Concluding our discussion on shopping for car insurance on a budget in Australia, we’ve delved into key aspects like policy inclusions/exclusions, budget-friendly companies, and maximizing discounts. This summary encapsulates the essence of our exploration in a captivating manner.

FAQ Summary

What are the key factors to consider when shopping for car insurance quotes on a budget?

Key factors include your coverage needs, deductible amount, and any additional benefits you require within your budget constraints.

How can online comparison tools help find affordable quotes?

Online tools streamline the process by allowing you to compare multiple quotes quickly, ensuring you find the best deal within your budget.

What are common inclusions in car insurance policies?

Common inclusions are liability coverage, collision coverage, and comprehensive coverage, each serving different purposes in protecting your vehicle.

How can policy inclusions and exclusions impact budgeting for insurance?

Understanding these aspects helps you budget effectively by knowing what is covered and what isn’t, preventing unexpected expenses.